Over two-thirds of people living in poverty in old-age are women. Start putting money aside for your retirement as early as possible – the best time to start is now!

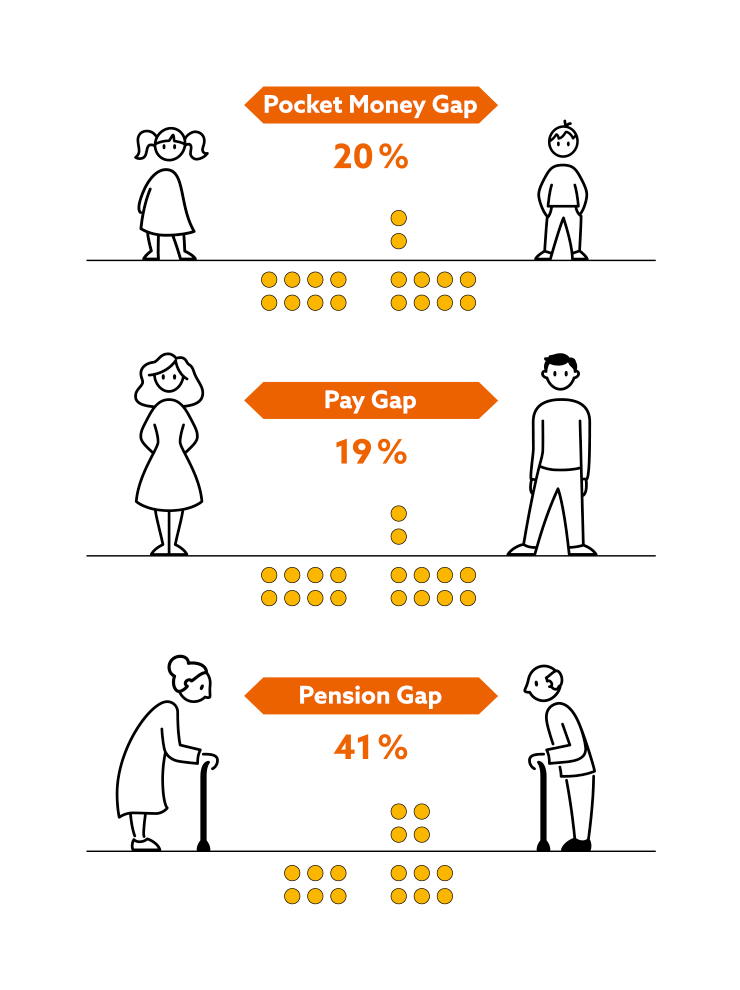

All the financial decisions that a woman has taken over the course of her life become suddenly noticeable – part-time working, long periods of maternity leave… Women receive 41% less pension than men. You can also plan for the future even with small amounts – here are some options:

Supplementary insurance contributions to your state pension

You can increase your state pension by increasing your own contributions – you can determine the amount yourself. You can simulate your future pension benefit using the pension calculator. There you can also enter potential future events, like unpaid leave, part-time work, early or deferred retirement, and then calculate your expected pension amount.

Pension splitting

Parents can agree a voluntary pension splitting for the years while raising children. The parent who is working transfers parts of their credit balance in their pension account into the pension account of the parent looking after the children. An application should be submitted to the Pensionsversicherungsanstalt at latest before the youngest child turns 10.

Private pension insurance

Such products are based on either classic or fund-linked life insurance plans. At the end of the accumulation phase, you receive a monthly pension for the duration of your lifetime or a one-off lump sum pay-out. You determine the term and the amount of the premium yourself. Compare and take note of contractual guaranteed benefits!

Investment funds – savings plan

You can purchase units in investment funds or ETFs on a regular basis – for a chosen amount that you may increase, reduce or suspend at any time. If necessary, you can even cash in your credit balance at the current price. Consider the risk that funds prices are subject to volatility and that risk and return always go hand in hand.

Also consider the “Abfertigung neu” severance scheme

Your employer pays in 1.53 per cent of your monthly income into the corporate provision fund. You are not able to pay contributions yourself, but are still able to influence the final result. The more hours a week you work, and the more contribution months you accumulate, the higher your severance pay-out will be. There is a capital guarantee on all amounts that are paid in for you.

Summary

Make sure you maintain an overview and stay informed! You can easily take a look at your individual pension account. Do you feel overwhelmed, or are you afraid of doing something wrong? You are not alone! Make use of the services offered by various advice centres for women and licensed financial services providers. Be active! The biggest risk is from not being active or from relying on others.

This edition was created in cooperation with the Federal Ministry of Finance.

Sources: pocket money: Bankenverband – online survey conducted in 2020 of 1010 parents, marketmind • Gender Pay Gap: Eurostat indicator “Gender Pay Gap” 2021 / ec.europa.eu • Pension Gap: staedtebund.gv.at / calculations: MA 23 – Wirtschaft, Arbeit und Statistik der Stadt Wien, Source: Pensionsversicherungsanstalt

Further information:

The following links contain information in German

Women and Pensions (bundeskanzleramt.gv.at)

Information for calculating your pension in Austria (sozialministerium.at)

Financial Literacy – National Financial Literacy Strategy (bmf.gv.at)