For many, ETFs are an entry point to capital markets, but what is behind them?

The money from many investors is bundled together in an Exchange Traded Fund (ETF), and the collected capital is used to buy assets, such as shares or bonds. You do not buy individual securities, but instead buy units in a package of securities. Exchange-traded means that units can be bought or sold at any time during the trading hours of stock exchanges. By doing so, you have the advantage of being able to use changes in price to your own advantage. An ETF tracks an index. This approach is known as passive management because the fund management does not actively take targeted investment decisions. The ongoing charges and management fees are therefore generally low. Depending on the chosen index, you can invest in entire markets, regions, countries as well as in sectors and commodities. Every index comprises of various assets – the more diverse they are, the broader the risk diversification.

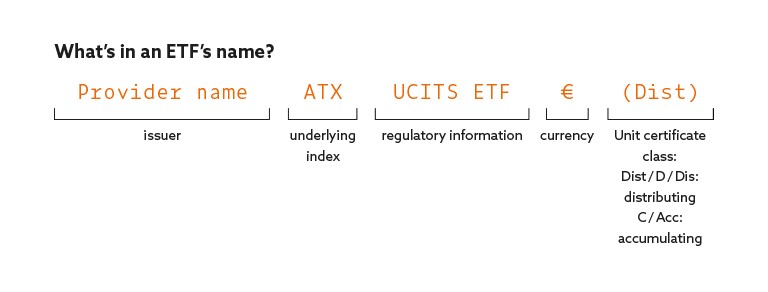

What do ETFs’ names mean?

Types of index tracking

If an ETF actually directly purchases all the assets of an index in as equal a ratio as possible, this kind of tracking is known as physical replication. Optimised replication is where an ETF only buys an optimal selection of assets, supplemented by derivatives. In this case, as an investor, your bear the market risk i.e. any developments that may have a negative impact on the financial markets. In synthetic replication, an ETF holds securities that do not have anything to do with the index, and at the same time concludes a swap agreement with a bank. The bank is obliged to offset the differences between the performance of the index and the basket of securities held by the fund. In this case, in addition to the market risk, you also bear the deafult risk of the swap partner.

What happens to the returns?

Distributing ETFs regularly directly pay out dividends and interest to you, the investor. The money is booked to the clearing account of your securities account. In contrast, accumulating ETFs reinvest the generated means into new assets. The money therefore remains in the fund and you do not need to take care of reinvesting it, but in so doing do not have any steady income.

Is there an issuer risk?

As a fund, ETFs constitute special assets that are held separately from the assets of the fund company (the issuer). This means that your assets continue to exist even in the case of the management company becoming insolvent.

Index

A basket of securities which tracks a specific market, e.g. The ATX or DAX.

UCITS

Funds are investments funds

that are subject to the strict investor protection rules of the EU’s Investment Directive.

The FMA’s Funds Database

lists all ETFs that are allowed to be distributed in Austria: AIFs and UCITS

Other editions:

15 Borrowing interest rates: fixed/variable

16 Trading on platforms

17 Investment Advice

A to Z of Finance:

You can final important basic

information about Investments on the FMA website.