You’ve recently received a severance pay-out, sold a property

or have money available for other reasons. You want to invest this money

but want some investment advice first – who is allowed to advise you?

Investment advice – what happens exactly?

The investment adviser must carefully examine your personal financial situation, the investment objectives you are pursuing and how high your risk appetite is. Also, investment advisers must explain all the risks and costs involved. All the information that you receive must be complete, understandable and correct. Advisory meetings must place you in a position to have a clear overview about all the effects of an investment decision, in order for you to arrive at a choice that is good for your financial well-being. If the investment adviser makes a recommendation, they are required to draw up a suitability statement – only once this has happened is a contract allowed to be concluded.

You should always check

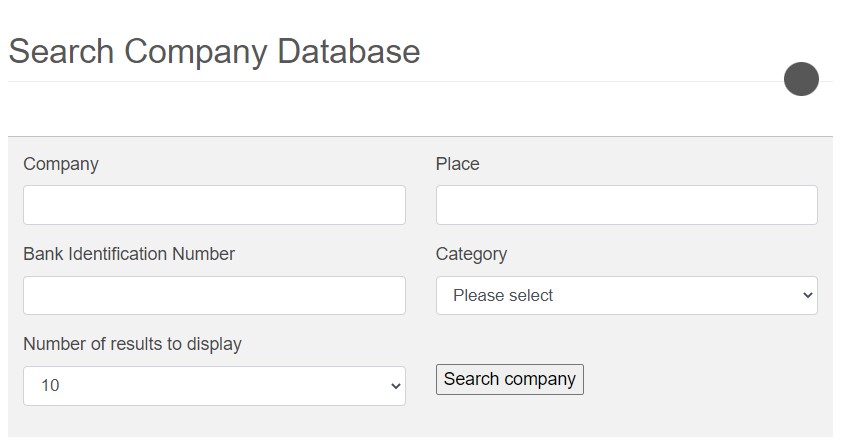

… whether the company you have chose to advise you is authorised to do so in Austria, in the Company Database

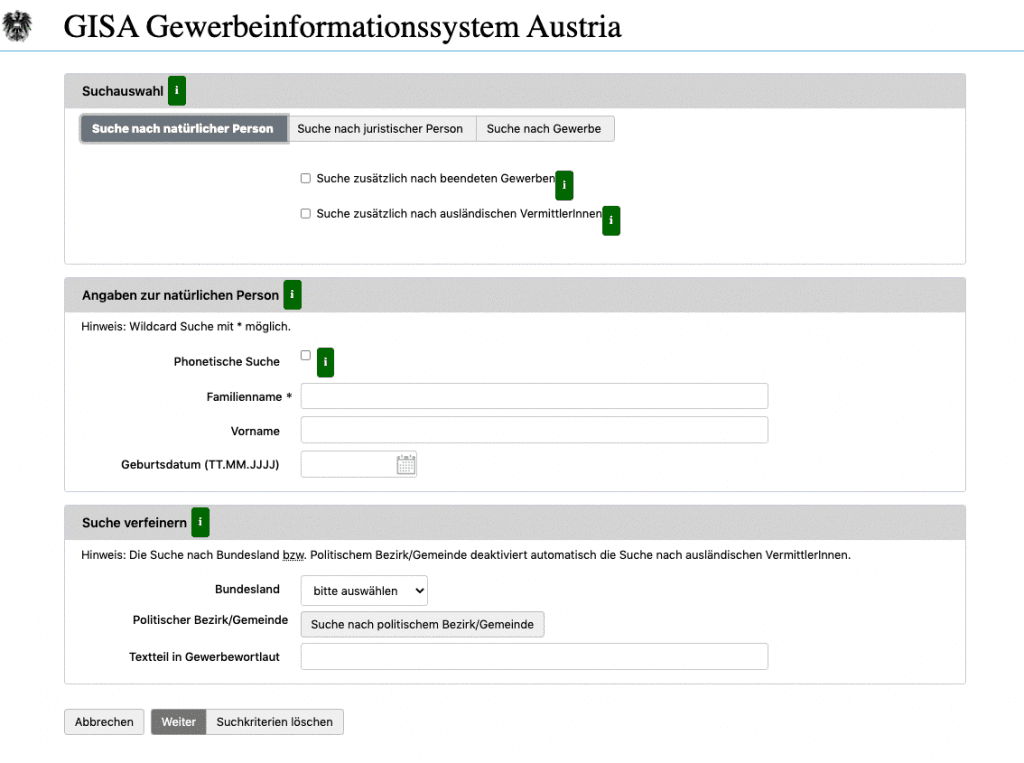

… whether the intermediary you have chosen holds a business licence, in the Gewerbeinformationssystem

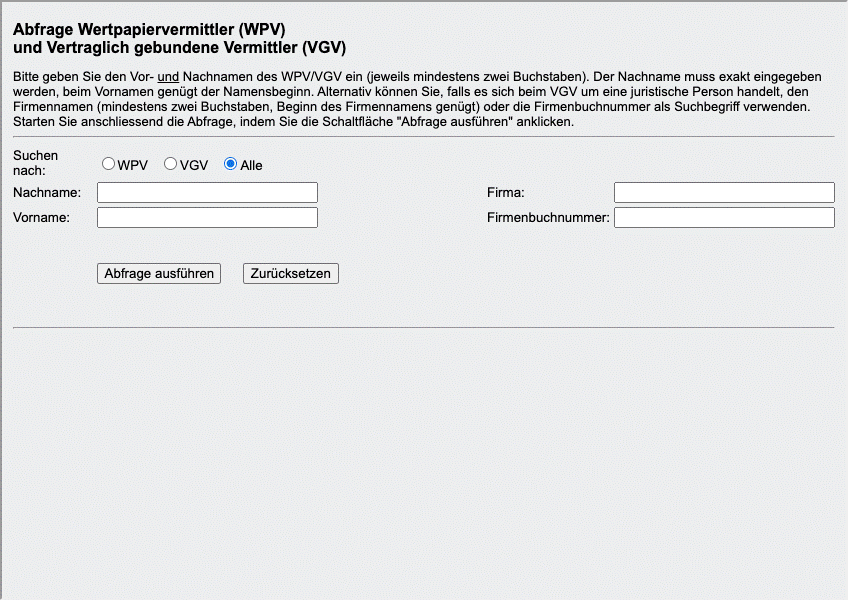

… for which company the intermediary you have chosen is allowed to act for, in the Tied Agents and Investment Intermediaries Query

Who is allowed to offer investment advice?

Banks, investment firms and investment services providers are allowed to advise you prior to making an investment decision. Investment services providers are restricted to advising about investment funds and transferable securities, for example shares and debt securities. Additionally, companies based in the European Economic Area (EEA) are allowed to operate in Austria under the freedom of establishment and to provide services.

Licensed entities are allowed to make use of assistants:

tied agents and investment intermediaries.

Contract concluded between you and the company:

Contracts are not concluded with the intermediaries, but with the licensed entities that they represent. These entities must ensure that the intermediaries have the necessary knowledge and experience for investment advice, and are liability for the conduct of the tied agents and investment intermediaries.

Please be aware of the difference between investment advice and direct sales by issuers:

Companies often directly sell the securities that they themselves have issued. In this case it does not constitute investment advice. This means that no customer profile is drawn up for you, and no checks are conducted whether their own product is actually appropriate, suitable and in your interest. It is pure marketing spin, you do not enjoy any specialist consumer protection – and in the worst case, the investment may negatively impact your finances.

Tied Agents (VGV)

are only allowed to be active for a single company.

Investment intermediaries (WPV)

are only allowed to act on behalf of three investment firms or investment services providers and

must disclose for which company they are currently acting.

Suitability statement

A written explanation about the extent to which the recommendation corresponds to your preferences, aims and financial situation.

Other editions

Further information:

Further details about investing can be found on the FMA website in the section on Investments

Advisory meetings – these principles must be observed!

and

Psychological traps when making investment decisions and how to avoid them