Watch out if you are already short of money! Paying the purchase price later makes goods even more expensive.

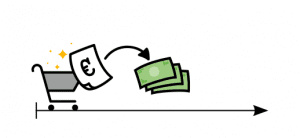

Buying on account

You receive a bill to be paid within a few weeks when you received the goods.

CAUTION

If you are late in making the payment, there are high fees and interest payments!

Payment holiday

You only have to pay the full purchase price once a grace period has passed.

CAUTION

If you are unable to pay then, it gets expensive! Don’t lose track of your payment commitments!

Payment in instalments

You pay the purchase price in regular smaller instalments.

CAUTION

Interest and fees mean that the goods become more expensive than if paid for up front!

Credit card

The amounts you spend are accumulated and are only debited from your bank account the following month.

CAUTION

Remember to take annual rates and interest payments into account!

How much does a payment deferral cost?

The additional time that you are have until you repay your debts, usually comes at a cost, namely one-off or regular interest payments. Bear in mind that your needs can change during this time. Often new consumer wants emerge, and old ones become less important.

Your data is also valuable!

If you are offered a free payment deferral, you usually pay by providing your personal details. Companies collect data in order to find out as much as possible about you as a customer. You then will received personally tailored advertising, which tempts you to make further purchases or to take out further loans.

If a debt collection agency gets involved, it gets expensive!

If you do not repay your debts, many companies choose to enlist the services of debt collection agencies. They try to recover the money, and charge you high fees for doing so. If you are confronted by high fees, contact a free government recognised debt counselling service. The sooner you take action, the better the outcome for you.

Do you have an overview of your payment commitments?

A payment deferral can turn into a real debt trap. Especially where you frequently make use of different models, it becomes easy to lose sight of which bills you have already paid, and which debts are still outstanding.

Debt collection charges

may only be charged in the event that the debt collection agency has taken action, e.g. has written a letter. The debt collection agency’s activity must be both necessary and appropriate, and must of a suitable proportion to the outstanding amount. The provisions in the Regulation on Debt Collection Charges apply regarding the fee level.

Tips

- Put aside some money on a monthly basis, and only make a purchase once you have saved the full amount.

- Withdraw the amount you have available to spend each week, and use that amount to may all purchases.

- Keep a budget notebook, or use the budget calculator (in German only) provided by debt counselling services.

- Restrict the option to go overdrawn on your account! Any overdraft is no different than an expensive loan.

- Paying by card entices you to spend money! Every banknote that you remove from your wallet, makes you aware that you have just spent money!

This edition was written in cooperation with Austria’s debt counselling services.

Other editions:

Further information:

Budget calculator (in German only)

Austrian debt counselling services

Important basic information can be found on our website: Loans