Are you buying a home and need to take out a mortgage and are wondering whether fixed-rate or variable-rate borrowing is better?

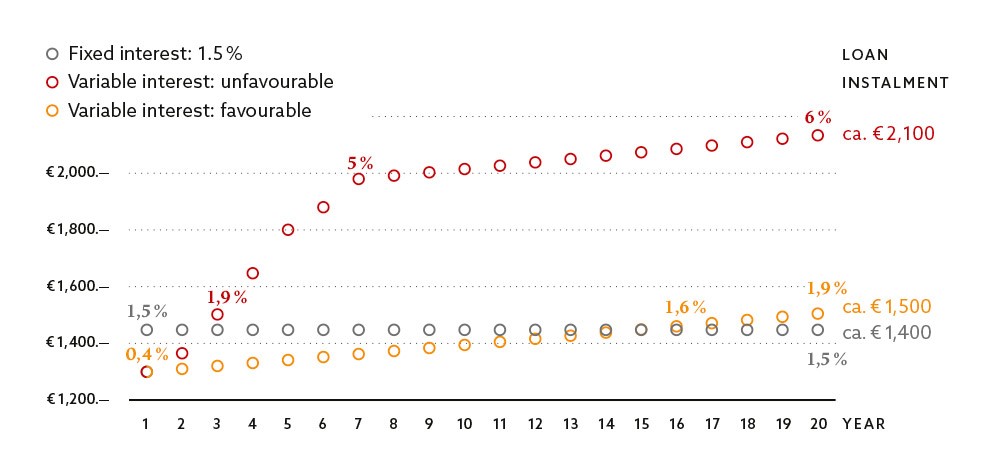

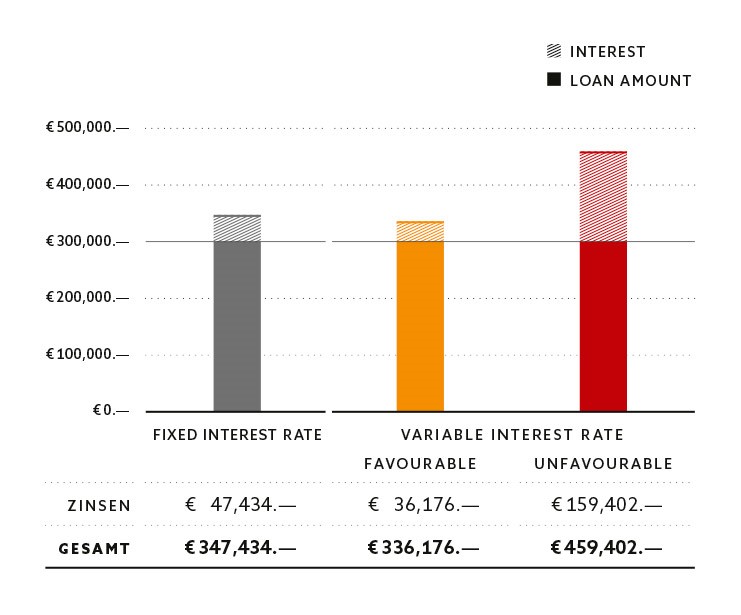

Attention! Do not rely on currently historically low interest rates remaining that way forever. Always take into account interest rates rises. Such rises can have a dramatic impact on your month repayments, and therefore on the total amount that you repay. The FMA has calculated three potential scenarios for a loan for an amount of € 300,000:

- one scenario uses a fixed interest rate

- one scenario uses a variable interest rate in the event of a favourable development in interest rates, and

- one scenario uses a variable interest rate in the event of a unfavourable development in interest rates.

Variable interest rates fluctuate and are guided by the current market interest rate levels, whereas fixed interest rates remain the same for the agreed time horizon.

3 scenarios: with monthly loan repayments with either fixed or variable interest rates

Total repayment for fixed or variable interest rate loans

Attention! The monthly repayment varies between € 1,299 and € 2,133. By opting for a fixed interest rate, you are protecting yourself against interest rate increases. For as long as the variable interest rate is lower than the fixed interest rate, this security costs something, but one the interest rate exceeds the fixed interest rate, you save against such higher interest amounts. The total repayment amount varies by up to € 123,226 across the three scenarios, which is equivalent to more than other third of the loan amount taken out!

Nominal interest rate:

the fee that banks demand from borrowers for making a mortgage available

Effective interest rate:

contains the total costs of a loan, i.e. nominal interest plus the processing fee, brokerage fee, the entry of the right of lien, treasury fees…

ESIS:

an EU standardised information sheet that contains also important details about the contract; the bank must provide it to you prior to the conclusion of the contract

Other editions

Further information

In the section on the A to Z of Finance on our website, you can find further information about mortgage-backed loans.

Loans – interest and charges compared by the Arbeiterkammer.