Do you want your money to promote a clean environment, social issues and good governance? Think about it – your investment adviser will ask you questions.

Goals of sustainable investing – in the future considerations about return, risks and liquidity will also be supplemented by sustainability considerations. Your investment decision can influence future developments.

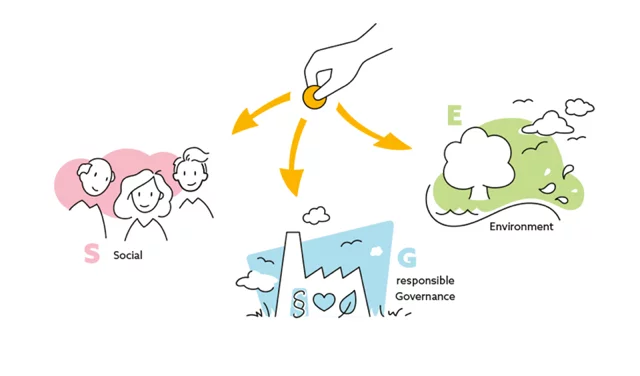

What is sustainable investment?

The financial sector should make a significant contribution towards achieving climate goals and to promote a sustainable economy. Harmonised European criteria exist about when an investment is classed as sustainable to achieve this contribution in an effective and sound manner. Your investment is sustainable when it makes a contribution towards achieving a social or environmental goal. In so doing, no other sustainability goal is allowed to be breached, and the companies in which you invest are required to apply principles of good and responsible governance. You can also choose to invest in financial instruments that while not promoting anything positive also avoid anything negative. In this way you can choose specific issues, for which it is particularly important for you to prevent their detrimental effects, such as greenhouse gas emissions, dealing in arms, or child labour. Investment advisers are only allowed to recommend products that are in line with the sustainability preferences that you have mentioned! You have the possibility to alter those preferences at any time.

How strongly do you wish to consider sustainability in your portfolio?

As an investor, you can determine a minimum level in percentage terms about how strongly the chosen sustainability preference should be taken into account in your portfolio. You can choose whether this should be for a minimum proportion by financial instrument, for the sum of money that is to be invested, or for your entire portfolio. If you do not provide any sustainability preferences, then you are classified as “sustainability-neutral”. In that case, you may be recommended both sustainable and non-sustainable financial products.

E for ENVIRONMENTAL – six EU environmental goals:

Climate change mitigation, climate change adaptation, protection of water and marine resources, a circular economy, pollution prevention and biodiversity.

S for SOCIAL

Social goals include, for example, poverty reduction, gender equality, education, hunger reduction, human dignity and equal opportunities.

G for GOVERNANCE

Good governance requires IT security, diversity, compliance with legal regulations, transparent structures etc.

A to Z of Finance:

Important basic information can be found on our website: Investments