The Regulation issued by the FMA should ensure that housing loans remain serviceable – even if your financial situation worsens.

The new conditions for housing loans for private persons since 01 August 2022

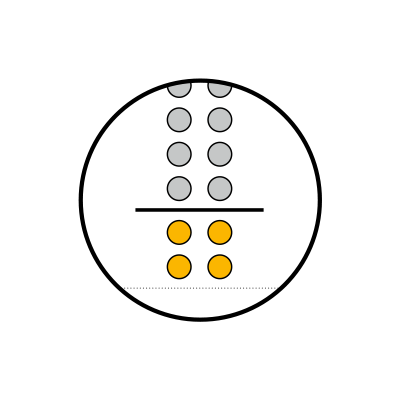

Total annual repayments (including interest payments) of all a customer’s loans are not allowed to exceed 40% of available annual net income.

The maximum permitted term of the loan is 35 years.

All housing loans must be secured with collateral, with the loan amount a maximum of 90 % of the value of the collateral. For a loan for € 100, collateral of at least € 111 must be pledged to the bank. Collateral may not only include mortgaged property, but also financial collateral like stocks, bonds, gold, cash or insurance policies.

Financing up to a threshold of € 50,000 is excluded from such rules, to simplify lending for renovation and maintenance projects.

Limited numbers of exceptions are permitted for every bank for customers that don’t fulfil the criteria despite good creditworthiness.

Consider the following example of how this applies.

You take out a € 300,000 loan to buy an apartment. The loan is to be repaid over 20 years at an effective fixed-interest rate of 2.5 %. Monthly repayments of approximately € 1,600 mean you must prove at least € 48,100 in annual net income. Furthermore, you would need to pledge collateral of at least € 333,000 to the bank for your € 300,000 loan. It is important that your total annual repayments do not exceed 40 % of your annual net income. This is important to allow you to build up reserves for unforeseen events like illness or unemployment. Doing so means you are still able to keep up with repayments even if your income is reduced.

If you were unable to keep up repayments, it could lead to the compulsory sale of your apartment. If property prices were also to fall sharply, you would have to sell your apartment for less than you paid for it. In this case, you would be unable to repay the loan in full if the level of debt-based financing was too high. You would end up without an apartment and saddled with a mountain of debt. Please avoid becoming overindebted and financing buying property by excessive borrowing!

The Financial Market Stability Board (FMSG)

has the duty to detect threats for financial market stability and to recommend actions to be taken to the FMA. Its members are drawn from the Ministry of Finance, the Fiscal Advisory Council, the OeNB and the FMA.

Mortgage

A right of pledge entered in the land register on a property for the purposes of securing a loan.

KIM-V

The Regulation on measures in real estate financing at credit institutions purpose is to limit of systemic risks

Other editions:

A to Z of Finance:

Important basic information can be found on our website: Loans