While consumer loans can be taken out in a few clicks, the consequences may be felt for a long time. What to watch out for when taking out a consumer loan.

You see a new television, a new smartphone, or new living room furniture that you would like to buy. You can’t really afford it at the moment, so consider taking out an online loan to pay for the product in several instalments.

What you should look out for with online consumer loans:

As soon as you borrow money, it will cost you money

Banks market loans aggressively for being used for financing purchases of consumer goods. Before taking out a loan, consider whether you actually need the product, and whether you can repay instalments until the loan is paid off.

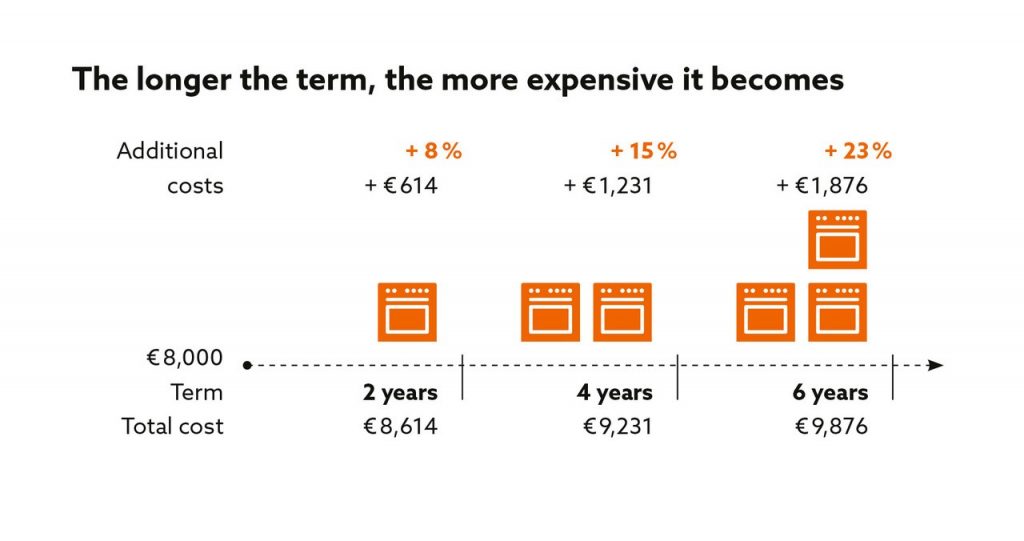

The longer the term, the more expensive the loan generally becomes

We would advise warn against a loan with a longer term merely in order to make lower monthly repayments. Longer terms and higher loan amounts mean increased costs for online consumer loans. Loans for a large amount over a long term can prove particularly expensive.

Sample Calculation

We buy a kitchen for Euro 8,000 — with an interest rate of 7.2 %: If you take out Euro 8,000 repayable over six years, it is 23 % more expensive (almost a quarter!) than if purchased outright.

Prices vary massively among online consumer loans

For a € 20,000 loan with a term of six years, the difference may vary by up to € 2,500. In addition to the agreed interest rate, every bank also charges additional varying fees and charges.

Often important information is hidden in the “small print” – make sure you look for it

As soon as an advert for an online consumer loan contains information about interest and costs of the loan, there must be a “representative example”. This example must be clear and simple and contain certain standard information, so that you can obtain a clear breakdown of costs.

Be critical of the results provided by online loan calculators!

Banks often use online loan calculators to allow you to perform a sample calculation of costs. However, loan calculators and representative examples frequently give different answers in terms of costs. The interest rates used by the loan calculator do not fully portray the reality. Under some circumstances actual monthly instalments may be significantly more expensive than the amount calculated using the online loan calculator.

It is always a good idea to compare different online consumer loans

Online consumer loans are offered by direct banks as well as traditional banks. In addition to the costs of the loan, other factors for your decision are the availability of the customer service department, and handling of the collection of the loan. If a debt collection agency is used for chasing up arrears, you will face considerably higher charges.

Compare the effective interest rate of the various products

In addition to debit interest, the effective interest rate contains fees, commissions, account management fees, processing fees and costs of required insurance policies. The effective interest rate expresses total costs of the loan as an annual percentage of the total amount of the loan. In contrast the borrowing rate only describes the annual amount of interest for the amount of the loan, excluding any associated charges.

Aggressive marketing

Advertising that targets consumers’ consumption and status requirements, and in doing so hides or does not mention the costs incurred. Aggressive marketing is one of the most frequent causes for people getting into debt.

Standard information

Such information must contain the borrowing rate, total amount of credit, an annual percentage rate of charge and as appropriate the term of the loan, the total amount to be repaid as well as the amount of the payment instalments.