When buying units in a fund, you are charged fund fees. Is your fund expensive or cheap?

What is an investment fund?

Capital belonging to a large number of investors is bundled in an investment fund and invested. As an investor you are joint owners of the fund. For example, there are real estate funds, equity funds or bond funds, depending on the types of assets capital is invested in. The fund manager is responsible for how the fund capital is specifically invested. The investment fund management company collects fees for investing in the fund and managing it. It is worth comparing fees!

Types of fees for funds

The maximum entry chargeis the maximum amount, expressed as a percentage, of the fee that is to be paid on a one-off basis when purchasing units in a fund. It is usually passed on as commission for mediation to the distribution channel. The maximum entry charges are required to be stated in both the fund regulations as well as in the Key Investor Information Document (KIID). The actual costs of the fund during a year as a percentage of the NAV are expressed in the KIID as ongoing charges; they may therefore vary from one year to the next. The ongoing charges cover all types of costs that the fund has to bear. The components of the ongoing charges consist of management fees, custodian banks fees, fees for investment advisers, all payments that may be incurred as a result of outsourcing, registration fees, supervision fees or similar fees, remuneration of statutory auditors, remuneration for legal and business advisers as well as any other distribution fees.

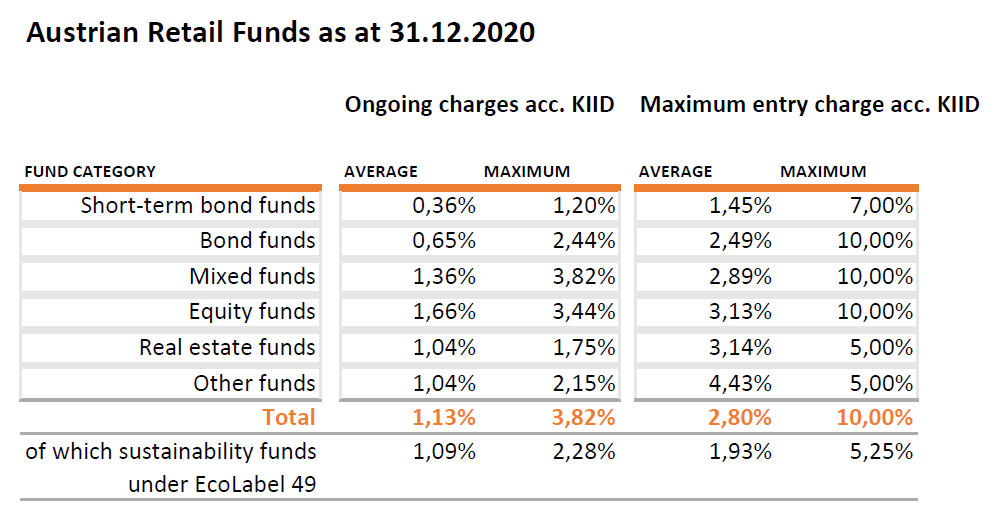

Market Study on Fees charged by Austrian Retail Funds

The FMA conducts an annual “Market Study on Fund Fees charged by Austrian Retail Funds”. This year, costs stated for 1,014 Austrian investment funds in their respective KIID were analysed, and mean values calculated to make it easier to compare charges. The finding of this year’s study again shows that funds that have a higher risk class charge higher fees. Equity funds as the most risky class of fund are also the most expensive category of funds along with other funds, while short-term bond funds have the lowest charges. Sustainable funds that bear the Austrian EcoLabel certificate charge marginally lower fees in comparison with the market as a whole.

KIID = Key Investor Information Document

The KIID contains important information about the fees, investment strategy and risk classification of an investment fund. It is in a standardised form and is provided free of charge.

More return = more risk

A higher return is always associated with a higher risk. Compare the typical market conditions and be critical.

Further information:

- You can read up on all this and more in detail in our FMA Market Study on Fees charged by Austrian Retail Funds

- PDF version of this article (In German only)

- Beware of financial scams!

A to Z of Finance

- You can find important basic information on our website: A to Z of Finance – Investments